A) LAST WILL & TESTAMENT

1 What is a Will?

2 What are the advantages of having a Will?

3 What happens if I die without a Will?

4 Is the Will by WillsMalaysia.my legal?

5 Do I need to engage a lawyer to write my Will?

6 What is required to make a Will?

7 How much does it cost to make a will?

8 Where should I keep my will?

9 What will happen if my original will cannot be located?

10 When should I update my Will?

11 What is the Grant of Probate (GP)?

12 What is a Letter of Administration (LA)?

13 In what situation do we apply for a GP or LA?

14 Who are involved in a Will?

15 What does an Executor do?

16 Who qualifies to be an executor or trustee?

17 What is the role of a Trustee?

18 Can I appoint the same person as the Executor and Trustee?

19 Can any of my beneficiary(s) be a witness to my Will?

20 Can my Executor witness my Will?

21 Do I have to list all of my assets in my Will?

22 What are the inclusions in a Will?

23 What are the exclusions in a Will?

24 Do I need both GP and LA?

25 My IC number is not on my Dashboard

26 How to distribute assets?

27 Do I need to get government approval for the Will?

28 Why do we need alternate beneficiary?

29 What are your membership fees?

30 What is a Spouse Will?

31 Can a beneficiary also be an executor?

32 How to distribute property that is joint between husband and wife?

33 Does WillsMalaysia provide Grant of Probate service?

34 Does WillsMalaysia provide Letter of Administration service?

35 How many executors can I have in my will?

36 How do I create an account?

37 How do I add a listed company?

38 Can a non citizen be witness to my will?

B) POWER OF ATTORNEY (POA)

1 What is a Power of Attorney?

2 Types of Power of Attorney

3 Choosing your Attorney

4 What is the cost of this service?

5 Is it a legal document?

6 How long can I continue to make updates?

7 How long will the process take to draw up my Power of Attorney?

8 My Dad is unable to sign the Power of Attorney

9 What happens after I pay for my Power of Attorney?

C) KEYCARD HOLDER

1 What is a "KeyCard® holder"?

2 What can I unlock?

3 Am I a KeyCard® holder?

4 How many KeyCard® holders are there?

5 What should I do if I have lost or misplaced my KeyCard® holder ID?

6 How to use the KeyCard system?

D) SECURITY

1 Is my information secure?

2 Can my information get destroyed or lost?

E) OTHER QUESTIONS

1 Foreigners and Will

2 Does it matter where I live?

3 How can I document my own wishes?

4 Where can I get more information?

5 Can I call and talk to someone?

6 How do I register as a member with WillsMalaysia?

7 Do you offer any discounts?

8 What does first year FREE means?

F) NIRVANA ASIA

1 What are the detail of your partnership with Nirvana Asia?

2 Where can I see the discount code for Nirvana Asia?

3 Can I call Nirvana Asia directly and apply the discount code?

A) Last Will and Testament

1 What is a Will?

A Will or Last Will and Testament is a legal document which contains a person’s intentions as to how they wish to distribute their assets after they passed on.

The legal definition of a Will is covered in Section 2 of the Wills Act 1959:

“…a declaration intended to have legal effect of the intentions of a testator with respect to his property or other matters which he desires to be carried into effect after his death and includes a testament, a codicil and an appointment by will or by writing in the nature of a will in exercise of a power and also a disposition by will or testament of the guardianship, custody and tuition of any child.”

2 What are the advantages of having a Will?

Having a Will enables you to:

- - Choose your beneficiaries;

- - Choose how your moveable and immoveable assets are to be distributed;

- - Choose your trustee and executor of your choice;

- - Set up a trust for your minor children;

- - Write bequests for charities;

- - Choose the guardian of your minor children;

- - Speed up the distribution process;

- - Express your wishes for your funeral arrangements;

- - Express your wishes for organ donation preferences;

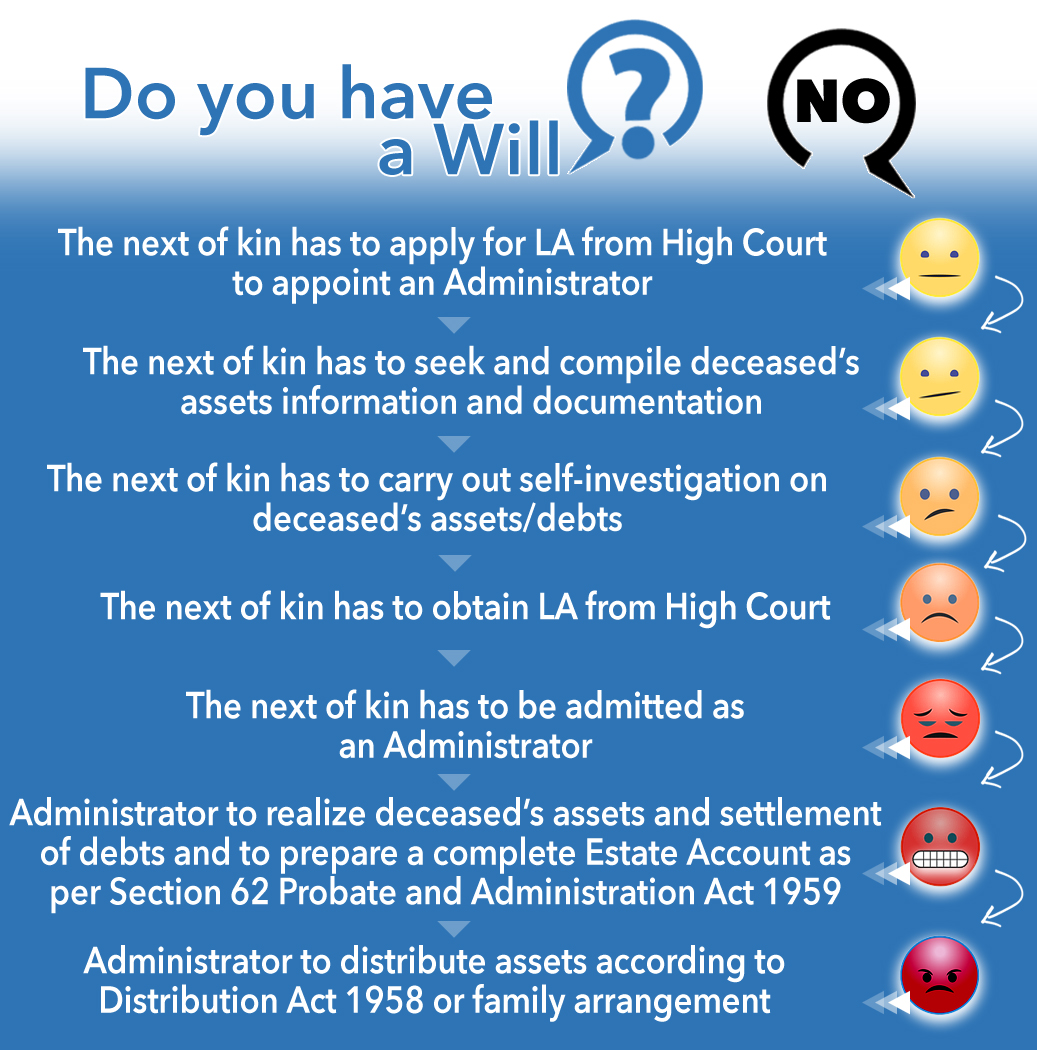

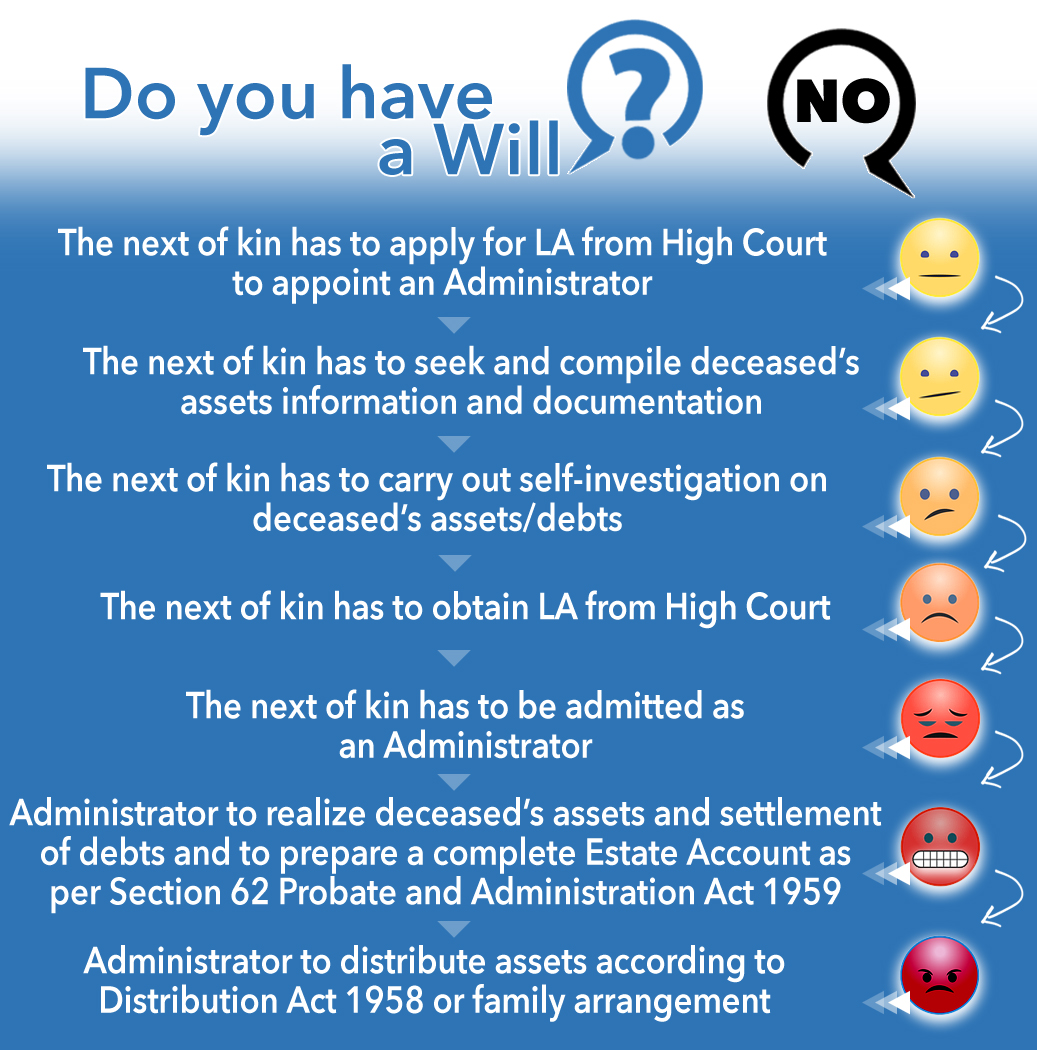

3 What happens if I die without a Will?

Without a valid Will, the law decides on the distribution of your assets. The law can also decide who your beneficiaries will be. Your loved ones could become involved in complex legal battle if you do not explicitly specify your wishes in a Will.

If you die without a Will:

Your estate will be distributed according to the Distribution Act 1958 (as amended in 1997) and the High Court decides over the administration.

The law does not provide for persons such as partners, step children, illegitimate children, relatives or basically anyone out of the family norm whom you could otherwise specifically include in a Will.

There may be costly legal fees and delays in administration when applying for a Letter of Administration.

The legal process could take years and your assets could shrink in value.

Not to mention your family members and/or dependents could face financial difficulties on top of a period of grief.

4 Is the Will by WillsMalaysia.my legal?

A lawyer is not required to write a Will, however using a system that was built in consultation with expert legal knowledge on Wills certainly helps.

Wills in WillsMalaysia.my have been carefully created by a team of experienced lawyers with specialised knowledge on Wills and Probate. So you can be sure the product meets all legal requirements as per the Will Act 1959.

5 Do I need to engage a lawyer to write my Will?

No, a lawyer is not required for you to write your Will.

6 What is required to make a Will?

To make a Will valid you must be:

- At least 18 years old (21 years for Sabah)

- Be of sound mind

- Have the Will signed and witnessed by at least two witnesses who will then sign in your presence and in the presence of each other.

7 How much does it cost to make a will?

The average cost of writing a Will using the services of a lawyer is around RM 800; hence at WillsMalaysia.my we make it affordable at a fraction of that cost. Check out our Products & Pricing page to learn more.

8 Where should I keep my will?

You should keep your original Will in a safe place which your executor should be aware, and have access to it. Using our FREE MyDigiSafe service, you can store a scanned copy of your Will.

We encourage members not to keep their Will in a bank’s safe deposit box. Remember when you die, all your bank accounts will be frozen, including your safe deposit box. This just makes it harder for your loved ones to locate or execute your Will.

At WillsMalaysia, we offer Will Custodial service where our lawyers will safely store your Will for you.

Watch this short video to learn more.

9 What will happen if my original will cannot be located?

The original Will is required before allowing a Grant of Probate.

However, a copy of your Will may be accepted if it can be proven that the original Will was lost or destroyed. And if you can proof there was no intention to revoke the Will. Using our FREE MyDigiSafe service, you can store a scanned copy of your Will.

10 When should I update my Will?

Ideally, you should review your Will every year. The best period to review your Will would be on your birthday. Of course, no one likes to review their Will on their birthday but what better time to look back on the last year on any major change in your life, eg:

- Getting separated or divorced

- Getting married (your existing Will becomes null and void)

- Having a child or adopting a child

- Migrating to another country

- Buying a car

- Starting a business

- Any other major life changes

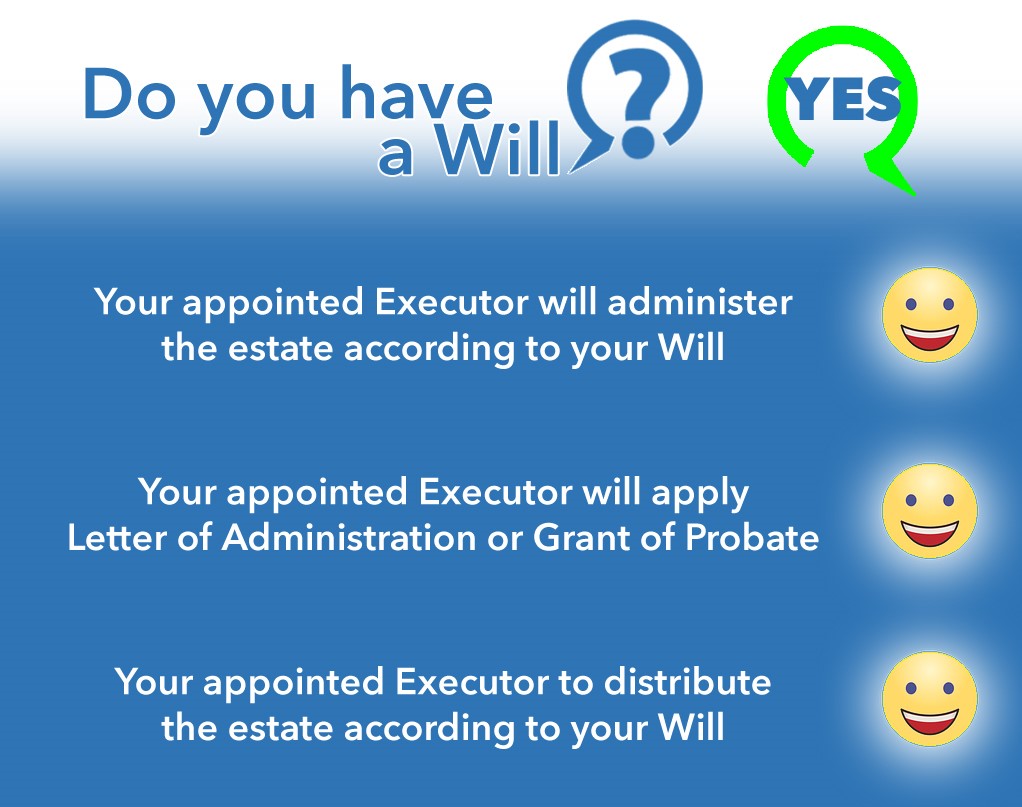

11 What is the Grant of Probate (GP)?

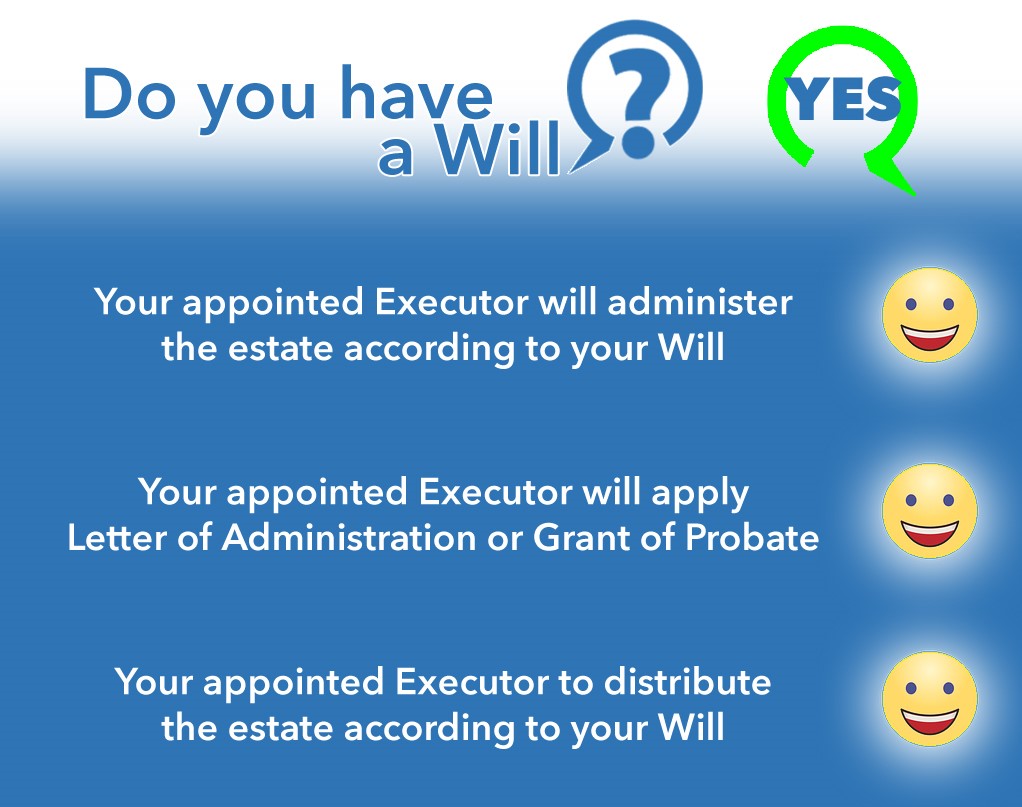

The Grant of Probate is a document an executor need to obtain in order to give them authority to administer the deceased’s estate.

12 What is a Letter of Administration (LA)?

An LA is a right given by the Court for the administration of an estate of a person who died without leaving a Will.

13 In what situation do we apply for a GP or LA?

When someone dies and leaves behind a valid Will, a GP will be sought. If the person dies without a Will, an application for an LA must be made.

14 Who are involved in a Will?

The parties involved in a Will are:

- Testator – A testator is a person who has written and executed a last will and testament that becomes effective at the time of his/her death. It is any "person who makes a will".

- Executor(s) – An executor is someone who is responsible for executing, or following through on, an assigned task or duty by a testator to administer his/her estate.

- Trustee(s) - The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

- Guardian – Person(s) appointed to care for the welfare of minor children.

- Beneficiaries - A beneficiary basically means a natural person or other legal entity who receives money or other benefits from a benefactor under a Will.

- Witnesses - two people who witness the testator signing the Will.

15 What does an Executor do?

The executor's job is central to the estate settlement process – from arranging the funeral, to paying bills, to distributing estate assets. After someone dies, the executor makes sure that the wishes stated in the deceased person's will are fulfilled.

16 Who qualifies to be an executor or trustee?

You may appoint any adult (18 years or older) to act as your executor and trustee; you may also appoint up to four executors to jointly administer your estate. You may also name alternate executors.

17 What is the role of a Trustee?

When your executor takes charge of your assets, he/she will also take the role of a trustee holding your assets on trust for your beneficiaries until the assets are fully distributed. Your trustee will be subject to the responsibilities imposed by the Trustee Act 1949.

18 Can I appoint the same person as the Executor and Trustee?

Yes.

19 Can any of my beneficiary(s) be a witness to my Will?

A beneficiary will not be eligible to receive any benefit from the estate if he/she or his/her spouse signs as a witness to the Will.

20 Can my Executor witness my Will?

Section 11 of the Wills Act 1959 allows an Executor to be a witness of the Will.

21 Do I have to list all of my assets in my Will?

We highly recommend doing so.

22 What are the inclusions in a Will?

Ideally, your Will should include all your assets:

- Immoveable asset: land and buildings, residential, commercial, industrial or agricultural properties/lands;

- Moveable asset: cash, bank balances, shares, transferable memberships, vehicles, movable furniture, clothing, jewellery etc;

- Intellectual property: copyrights, patents etc;

- Trust property: property which is being held by a trustee on trust for you;

- Inheritance: assets which you expect to receive in the future.

23 What are the exclusions in a Will?

- Any Insurance policy(s).

- Your money in Kumpulan Wang Simpanan Pekerja (KWSP/EPF) account.

INSURANCE

In Malaysia, monies under insurance policies do not form part of the deceased’s estate. This is to protect the interests of the insured’s spouse and children in the policy monies against a claim by any creditor of the insured.

This is provided for in section 23(1) of the Civil Law Act 1956:

Moneys payable under policy of assurance not to form part of the estate of the insured

(1) A policy of assurance effected by any man on his own life and expressed to be for the benefit of his wife or of his children or of his wife and children or any of them, or by any woman on her own life and expressed to be for the benefit of her husband or of her children or of her husband and children or any of them, shall create a trust in favour of the objects therein named, and the moneys payable under any such policy shall not so long as any object of the trust remains unperformed form part of the estate of the insured or be subject to his or her debts.

The relationship between the insurer and the insured (or the “deceased” for the purpose of the article) is a contractual one (see the Federal Court decision in Malaysian Assurance Alliance Bhd v Anthony Kulanthai Marie Joseph (suing as a representative of the estate of Martin Raj a/l Anthony Selvaraj, deceased) [2010] 4 MLJ 749).

Therefore, upon the death of the insured, the terms of the insurance contract will take effect – all monies payable under the insurance policy will then be paid to the named nominee in accordance with the insurance policy and the Financial Services Act 2013 (“FSA 2013”).

Employees Provident Fund

The distribution of EPF mirrors that of insurance policies. The contributions and interest do not form any part of the deceased’s estate, and upon the death of the deceased, it shall remain separated from the deceased’s other assets (How Yew Hock (Executor of The Estate of Yee Sow Thoo, deceased) v Lembaga Kumpulan Wang Simpanan Pekerja [1996] 2 MLJ 474). If nomination was made, the fund will then be payable to the nominee.

Section 54(1A) of the Employees Provident Fund Act 1991 provides that the EPF member may make nomination for the purpose of payment of credit after the death of the member. When a nomination is made, it has the effect of appointing an individual or institution to receive and oversee the EPF savings in the event of one’s demise. A nominee would then be entitled to the nominated portion of the deceased’s EPF savings.

However, where the EPF member dies without first nominating a beneficiary, the member’s next-of-kin is entitled to make a claim for the monies in the savings. This includes:

the member’s widow/widower, children (or their guardian);

parents, or siblings for married members; or

parents or siblings for unmarried members.

If the deceased left a will with a residuary estate clause (a clause that disposes of assets that have been overlooked or are left over), then the EPF savings will form part of the residuary estate of the deceased EPF member and shall be distributed in accordance with his or her express wishes. If a grant of probate or letter of administration has been taken out for the deceased’s estate, the executor or administrator may then act accordingly to apply for the withdrawal of the savings for the benefit of the named beneficiaries or the next-of-kin, as the case may be.

MyLastWill product from WillsMalaysia does not cover Insurance Policy or EPF however all details of your Insurance Policies and EPF can be captured in our MyLegacy product.

24 Do I need both GP and LA?

You do not need both GP and LA. Depending on your situation, you will need one or the other. If you leave behind a will then your executor will need to apply for a Grant of Probate (GP). But if you don't then your next of kin will need to apply for a Letter of Administration (LA).

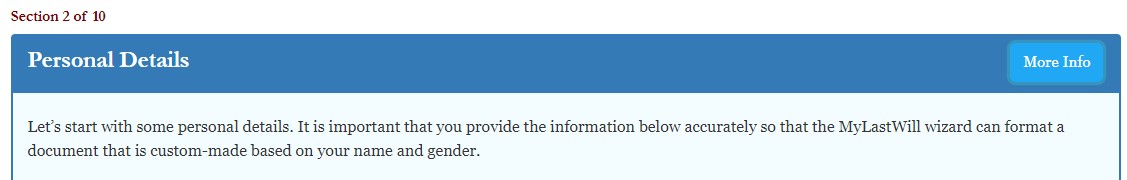

25 My IC number is not on my Dashboard

Your IC number will not be reflected on your dashboard. In Section 2 of 10 while creating your will, you will be required to input your IC. Once you have completed up to section 10 then from the dashboard you can “View” your will. You would be able to see your IC number right under your name.

Once you are happy with the preview, you can pay for it and download your will as a Microsoft Word document. From here onwards, you may check, print and sign together with two witnesses. Your will is then completed.

26 How to distribute assets?

Distribution are assigned in fractions; 1/3, ¼, ½ or any combination of. The total for each asset however should be equals to 1. For example if you have two beneficiaries A and B and would like A to have 1/3 and B gets 2/3. In this case 1/3 + 2/3 = 1. Or you can get a little bit more complexed; for example you have five beneficiaries A, B, C, D and E. Your distribution can be A=10/100, B=25/100, C=18/100, D=30/100 and E=17/100. In this case (10/100+25/100+18/100+30/100+17/100)=1.

27 Do I need to get government approval for the Will?

MyLastWill follows Malaysia Wills Act 1959 where for a will to be valid all it takes is to be signed by the testator (you) with two witnesses. The only requirement is to ensure the witnesses are not beneficiaries in your will. Once signed you may keep it in a safe place and we also highly recommend you use our FREE service MyDigisafe where you can upload a scanned signed copy. Alternatively you may also use our Custodial Services where our lawyers will safeguard the will for you. You pay only once but we will safeguard it for your lifetime.

28 Why do we need alternate beneficiary?

Though it is not required, it is always wise to nominate an alternate beneficiary. There could be cases where your primary beneficiary might have died before you or for whatever reason may refuse your bequest. In any case, you would want to consider nominating an alternate. For example you may bequest A your Proton car, however A does not want it or has died before you or right after you. In this case the executor will have to seek approval from other beneficiaries and decide what to do with the car. If you had selected an alternate for your Proton then the alternate beneficiary will receive the full share that A does not want.

29 What are your membership fees?

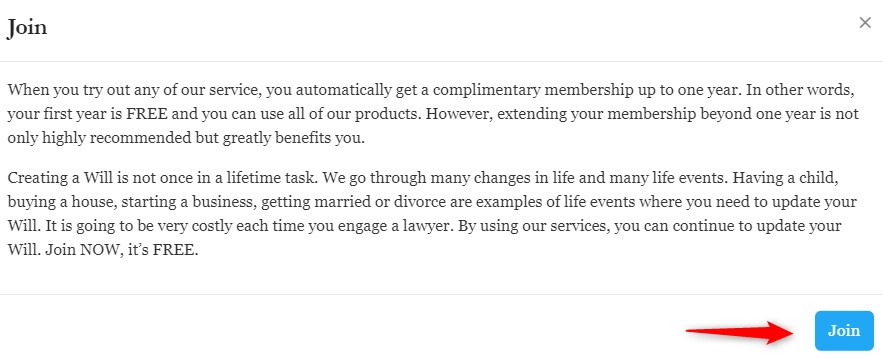

Creating a Will is not once in a lifetime task. We go through many changes in life and many life events. Having a child, buying a house, starting a business, getting married or divorce are examples of life events where you need to update your Will. It is going to be very costly each time you engage a lawyer. By using our services, you can continue to update your Will. To ensure it is valid, all you need to do is to sign it with two witnesses.

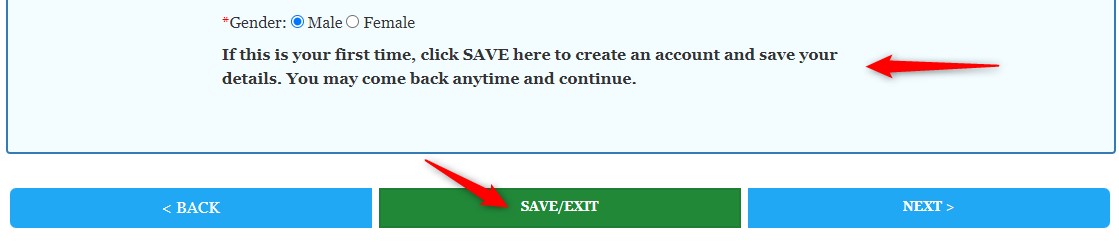

When you try out any of our service, you automatically get a complimentary membership up to one year. In other words, your first year is FREE and you can use all of our products. However, extending your membership beyond one year is not only highly recommended but greatly benefits you. But you pay only once for MyLastWill (RM269). To learn more about membership go to your dashboard and select “Extend Membership”

30 What is a Spouse Will?

The design for MySpouseWill is to ensure the spouse gets their own account and manage their own will. The wizard pretty much allows you to transfer data from you to your spouse, saving your spouse much input time and repetition. It was never the intention of one account holder to be able to manage both wills. The system was designed with privacy and security in mind. We respect you and your spouse’ privacy as two separate individuals. How you decide to manage it between you both is something WillsMalaysia does not and should not get involved.

Purchasing MySpouseWill has two benefits:

- Save a whopping 40% from the individual price

- Save time on data input and repetition tasks

The process to follow is:

- Individual1 tries MyLastWill

- Individual1 purchases MyLastWill

- Individual1 purchases MySpouseWill for Individual2

- Individual1 uses MySpouseWill wizard to transfer data to create a separate will account for Individual2

- Individual2 then logs in and maintains MyLastWill for him/her self.

This way both individuals get to use MyDigiSafe, MyLastMessage and MyLastWish separately. Both individuals can then use these FREE products with their personal data and private information as they wish.

31 Can a beneficiary also be an executor?

Yes a beneficiary can also be an executor. However a beneficiary must not be the witness to your will.

32 How to distribute property that is joint between husband and wife?

In the section 8.0 where you distribute your assets to your beneficiaries, you only bequest your share of the asset. So if you and your spouse own a house and you have 2 children, you can divide the house equally among them both. The legal verbiage in the will state that you only bequest your share of the house to both your children. When your spouse writes his/her will, he/she will do the same too.

33 Does WillsMalaysia provide Grant of Probate service?

Yes we do. We can provide an estimated cost upon review of your will. The average cost in Malaysia to obtain a grant of probate is between RM5 to RM10K, depending heavily on the work that has to be done based on the content of the will. Being a member of WillsMalaysia however, you will get a discounted price for using the services of our panel of lawyers.

34 Does WillsMalaysia provide Letter of Administration service?

No we don’t, but we will be happy to refer you to our panel of lawyers.

35 How many executors can I have in my will?

According to Malaysia Wills Act 1959, you can appoint anyone who is 18 years of age or older to act as your executor and trustee, with up to four executors. Just bear in mind if there are more than one executor then they have to jointly agree on all decisions and action to be taken. You can also name alternate executors to replace any of your executors should they predecease you, or renounce their executorship.

36 How do I create an account?

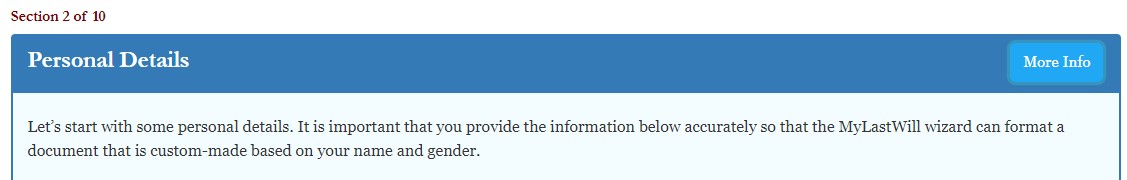

In Section 2.0 Personal Details, key in all details.

At the end of the page system will ask you to click SAVE to create an account.

You will then be prompted to Join page

You will then be taken to Join page where you can:

- Add new member information

- Create Userid and password

- Set secret questions

Then click Submit System will then take you to your Dashboard. From here select MyLastWill and continue.

37 How do I add a listed company?

Identify your brokerage company and CDS/CDP account number: You will need to provide the name of the brokerage company where you have your securities account and the account number. You should also include your CDS/CDP account number as this is required to transfer ownership of your securities to your beneficiaries after your death.

Draft a clause in your will: You can draft a clause in your will that specifies the brokerage company and CDS/CDP account number. This clause should clearly state the name of the brokerage company, your account number, and your CDS/CDP account number. You can also mention any specific instructions regarding the distribution of your securities to your beneficiaries.

Here's an example of how you could mention your brokerage company and CDS/CDP account number in your will:

"I hereby bequeath all my securities held in my brokerage account with [brokerage company name] (account number: [account number]) to [name of beneficiary]. I also direct that ownership of these securities be transferred to [name of beneficiary] from my CDS/CDP account number [CDS/CDP account number]."

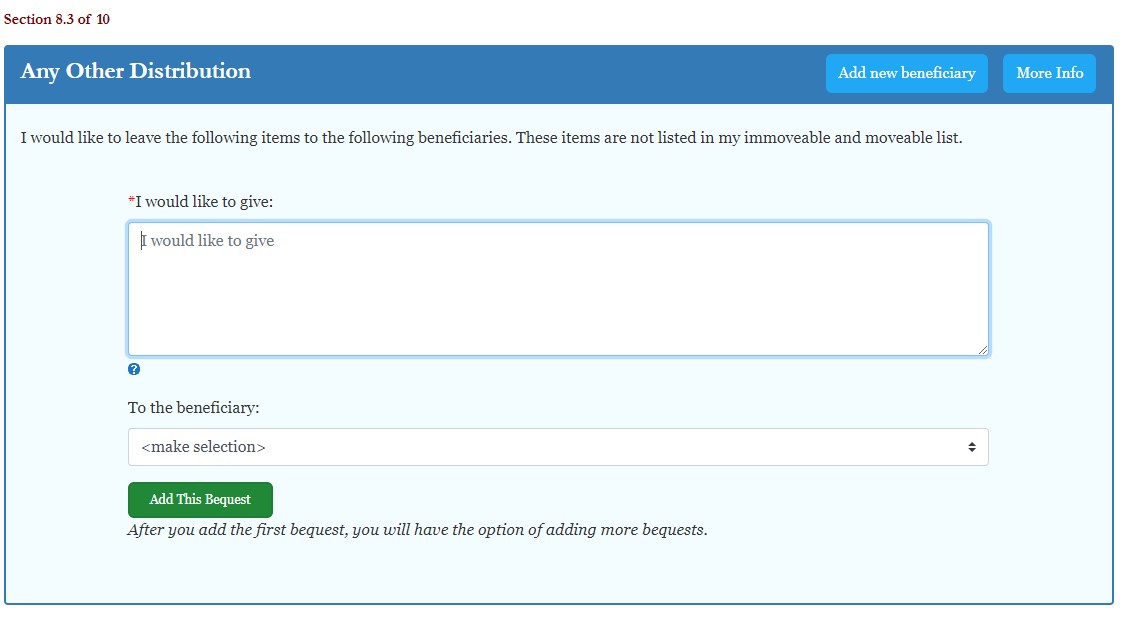

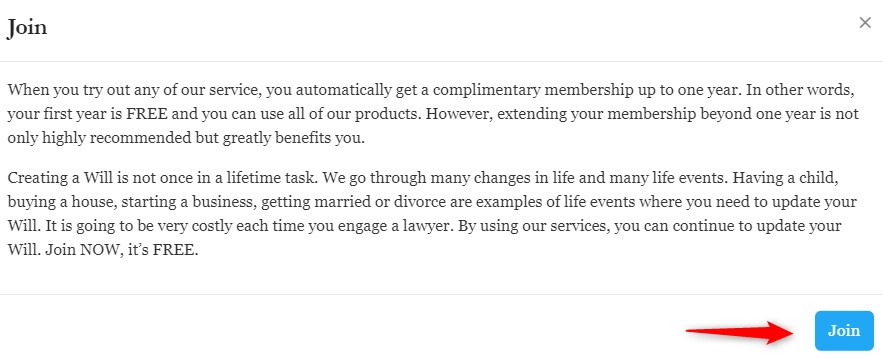

You may do so in Section 8.3 of MyLastWill

38 Can a non citizen be witness to my will?

Under the Wills Act 1959 in Malaysia, there are no specific provisions that prohibit a non-citizen from being a witness to a last will and testament of a Malaysian citizen. However, the law requires that a witness to a will must be competent to give evidence in court. This means that the witness must be of sound mind, not blind, and must be able to understand the nature and effect of the document they are witnessing.

Furthermore, it is important to note that the law in Malaysia requires that there must be two witnesses to the signing of a will, and that both witnesses must be present at the same time when the testator signs the document. This requirement is intended to ensure that the will is executed in accordance with the law and that there is a clear record of the testator's wishes.

In summary, while the Wills Act 1959 does not specifically prohibit a non-citizen from being a witness to a Malaysian citizen's last will and testament, the witness must still meet the requirements of competency and be physically present to sign the document along with another witness.

B) Power of Attorney (PoA)

1 What is a Power of Attorney?

A Power of Attorney is a legal document which allows you to grant the authority to someone to act on your behalf. People grant Power of Attorney for various reasons.

- You may have a business in your name but do not have the time or expertise to run it yourself so you grant a Power of Attorney to someone else to run it for you.

- You may have properties in Malaysia but live overseas. In this instance you may grant a Power of Attorney to someone giving them the rights to manage, sell, mortgage or execute any other property/financial related matters.

But the most important type of Power of Attorney is granting someone the authority to act on your behalf when you become incapacitated or mentally unstable. This is not a topic that people like to talk about but it is a very important one.

MyPoA wizard by WillsMalaysia creates a Power of Attorney that takes effect if you become mentally unstable or incapacitated. It creates an Enduring General Power of Attorney that covers your financial, real estate, business affairs and/or your health care directives. You may assign one individual for all of these needs or different individuals for different needs. However, if you wish for the Power of Attorney to be effective immediately (while you are in good health and sound mind), the wizard is able to do this as well.

Watch this short video to learn more.

2 Types of Power of Attorney

The Power of Attorney is general but gives significant power to the individual you select as your Attorney. Depending on the power you grant, your Attorney will be able to do the tasks you would normally do provided you are healthy, able and of sound mind. Let’s take a quick look at the three types of Power of Attorney MyPoA wizard creates.

Power of Attorney over your financial interest – this Power of Attorney grants the Attorney the power to manage all of your personal financial affairs including, but not limited to:

- handling banking transactions

- managing debts, bills and loans

- dealing in stocks, shares and bonds on your behalf

- manage, buy and sell real estate on your behalf (your property interest)

Power of Attorney over your business interest – this Power of Attorney grants the Attorney the power to manage all of your business affairs including, but not limited to:

- handling banking transactions related to your business

- managing, buying and selling real estate on your business behalf

- settling debts, bills and loans related to your business

- dealing in stocks, shares and bonds on your business behalf

Power of Attorney over your healthcare interest – this Power of Attorney grants the Attorney the power to manage all of your health affairs including, but not limited to:

- give directions and make decisions, on your behalf, concerning your personal care

- to give or refuse consent on your behalf to treatment

- choice of medical care providers

- choice of medical care facilities

Watch this short video to learn more.

3 Choosing your Attorney

The Attorney that you choose will be able to administer all of your financial, business, property and healthcare interests, and this will be their responsibility as long as the Power of Attorney is in effect, usually for many years to come.

The person that you select must be someone that you completely trust, competent in managing your affairs, is likely to remain alive for the duration of the Power of Attorney, and is willing to serve as your Attorney. It can be a friend, your spouse, your adult child or other family member.

Once it is signed and attested by a lawyer, the Power of Attorney has to be registered in Court. It comes into effect immediately when you have been declared by a medical professional that you are incapable of making decisions for yourself.

But if you wish for the Power of Attorney to be effective immediately, while you are in good health and sound mind, the Power of Attorney will be created accordingly.

Just bear in mind your Attorney will be able to do anything you will be able to should you be in sound mind and health. So it is important your choice of Attorney is someone you trust and has your best interest in mind. Most people would nominate their spouse or older children as the responsibility commands maturity and compassion.

Watch this short video to learn more.

4 What is the cost of this service?

The MyPoA™ service takes you through a series of simple questions using a wizard, formats your answers into easily readable format, and allows you to make unlimited updates until you finalize your Power of Attorney; while allowing you to store your information securely online.

A Power of Attorney is typically prepared by a lawyer and can cost you anywhere between RM800 to RM3000. Here at WillsMalaysia you can create a Power of Attorney at a fraction of the cost. We made it easy for you by removing all the legal jargons and by answering some simple questions, you too can create your Power of Attorney in under 20 minutes.

The price of using MyPoA is only RM 349. Government stamp duty, court registration and legal attestation fees are added separately. The complete breakdown will be provided to you before your make the purchase.

5 Is it a legal document?

It is in accordance to the current Laws of Malaysia and in full compliance with the Power of Attorney Act 1949. However, in order to be a legal document your Power of Attorney document must be signed (attestation) in the presence of a lawyer. A Lawyer has the legal standing to administer oaths and officiate over the signing process.

In other words, they are an independent person who will determine that all parties signed on their own free will, and that they are all who they say they are.

Upon attestation, the document has to be stamped by Lembaga Hasil Dalam Negeri and registered in the Malaysian Courts system. Our panel of lawyers will complete this process for you. You will need to pay the required regulatory and attestation fees separately. The final stamped and registered copy will be sent to you for your safekeeping. We suggest you take a scanned copy of the document and upload it to your DigiSafe, a complimentary service provided by WillsMalaysia.

Although the unsigned version of your Power of Attorney stored online at WillsMalaysia.my is not a legal document, if you wish, you may allow one or more of your designated KeyCard® holder to have access to the Power of Attorney that you have created at WillsMalaysia.my. This could be important if your legally signed copy cannot be located. In this situation, your WillsMalaysia.my Power of Attorney may still provide some guidance to a loving family, as they may understand how you would want your legal, financial and/or business matters to be handled.

6 How long can I continue to make updates?

You can choose to have a 1-year, 5-year, 10-year, 20-year or Life membership at WillsMalaysia.my, during which time you may make as many updates or amendments to your Power of Attorney as you wish -- at no extra charge. However if your Power of Attorney was registered in the Courts, the old Power of Attorney must be revoked and the new one re-attested by our lawyer. You will need to pay the required regulatory and attestation fees. Details of the membership packages may be found on our Products & Prices page.

7 How long will the process take to draw up my Power of Attorney?

The series of questions using the MyPoA wizard can be completed in less than twenty minutes. The wizard can create three types of Power of Attorney documents: Business, Financial and Healthcare matters. So, we recommend you take some time to read and think about it so as to ensure the Power of Attorney is not simply created, but you understand exactly what it means and the steps involved to make it a valid legal document.

8 My Dad is unable to sign the Power of Attorney

If your dad has problems signing or inability to sign, the law accepts thumbprint as long as it is done in front of a lawyer. That is the attestation process where the lawyer confirms your dad is the right donor (the person creating the PoA) and validates his IC.

9 What happens after I pay for my Power of Attorney?

Once you pay for your Power of Attorney, WillsMalaysia will notify our panel of lawyers. The lawyer's office will call you to make an appointment. You will need to print out the Power of Attorney in advance and bring it along to the appointment. During this appointment the lawyer will go through the Power of Attorney with you for signing. The lawyer will then manage the stamp duty and get it registered in the High Courts. After a few days you will get a copy of the Power of Attorney

Watch this short video to learn more.

C) KeyCard Holder

1 What is a "KeyCard® holder"?

WillsMalaysia members can choose any number of KeyCard® holders and the member can designate specific sections for access to specific KeyCard® holders. After this, the holders have the power to unlock the Will or other services after the member’s passing. Each KeyCard® holder has access to chosen sections of the document like MyLastWish, Power of Attorney, or Last Will and Testament, as directed by the WillsMalaysia member. WillsMalaysia.my is completely secure and always ensures the member’s privacy. Only authorized access by the correct KeyCard® holder at the right time, as specified by the member, will be able to view the member’s documents.

Watch this short video to learn more.

2 What can I unlock?

A member at WillsMalaysia has the option of documenting one or more of the following services:

- MyLastWill™ - The member's Last Will and Testament

- MyPoA™ - Directions regarding the handling of the member's health, finances and business.

- MyLastWish™ - The member's personal wishes regarding their funeral and organ donation preferences.

- MyLastMessage™ - Unsent messages the member has prewritten to their family or friends

- MyLegacy™ - Critical information to be passed on to the member's family and the executor

- MyDigiSafe™ - Important digital files and documents to be passed on to the member's family and executor

You may not be able to view all the above services. It depends on the member’s preference. The member can grant access to one individual to access all services or several individuals to access different services.

3 Am I a KeyCard® holder?

Did you receive an email identifying you as a KeyCard® holder of a named WillsMalaysia member? This email would have described your responsibilities and also assigned you a unique, secure, "KeyCard® holder ID", a combination of an alphanumeric code.

The member could have also contacted you directly and given the code themselves. The member could have also sent you a wallet card.

4 How many KeyCard® holders are there?

The member can designate any number of KeyCard® holders for their wishes. We encourage members to designate different individuals for different services.

5 What should I do if I have lost or misplaced my KeyCard® holder ID?

Please contact us.

6 How to use the KeyCard system?

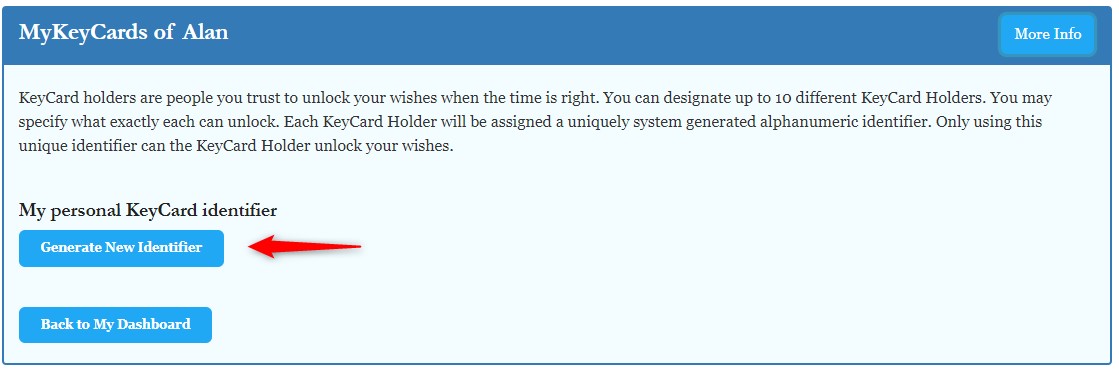

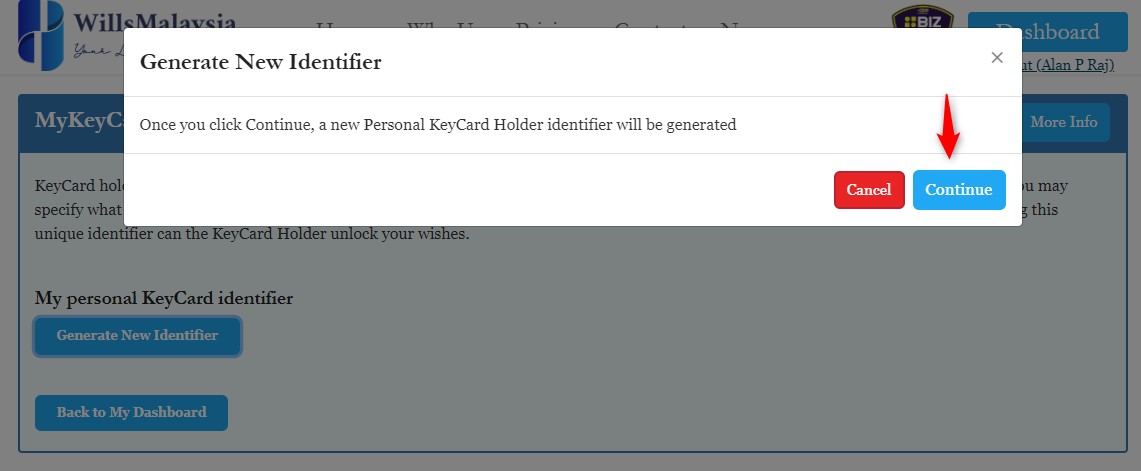

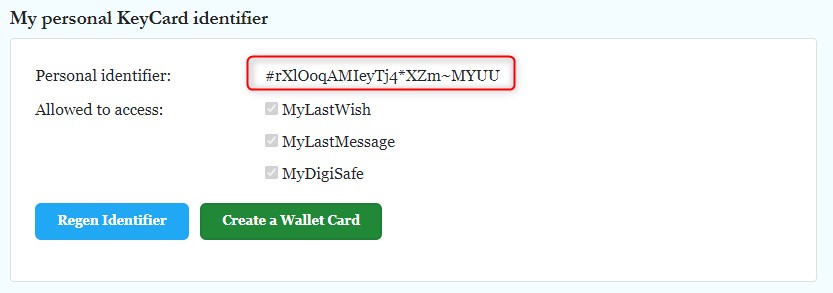

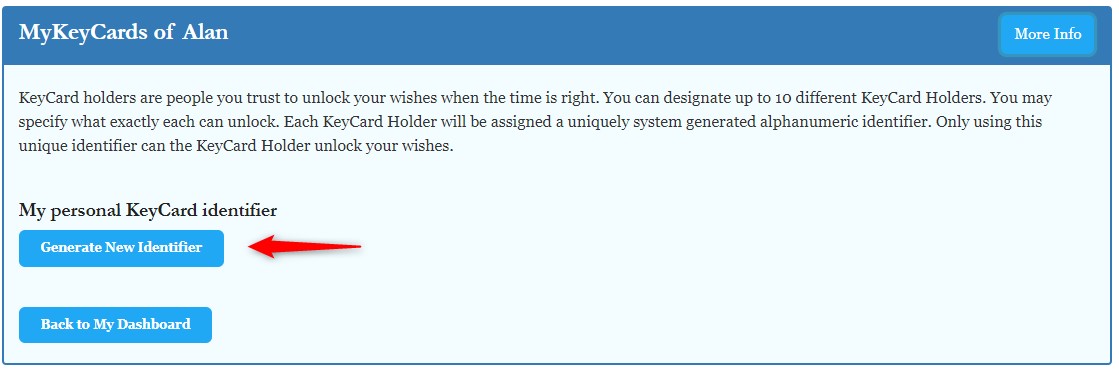

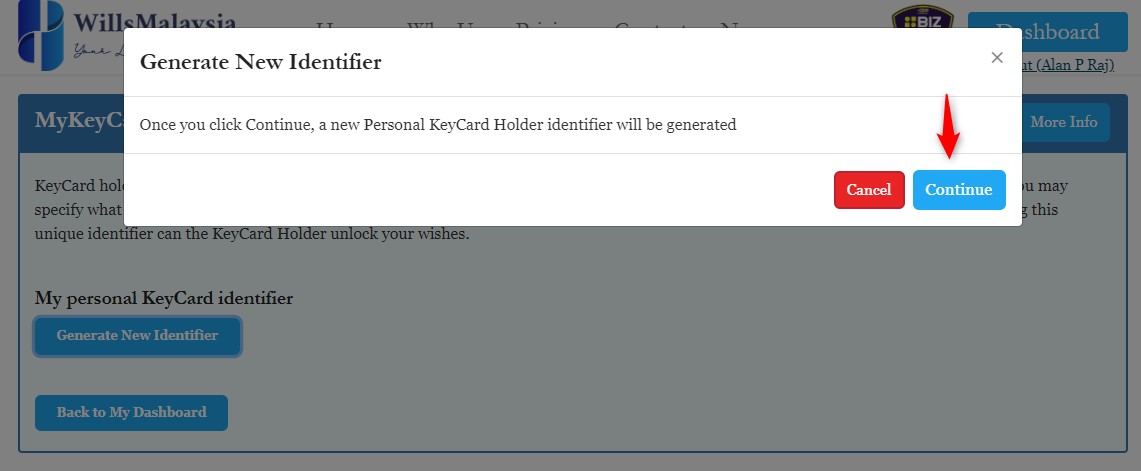

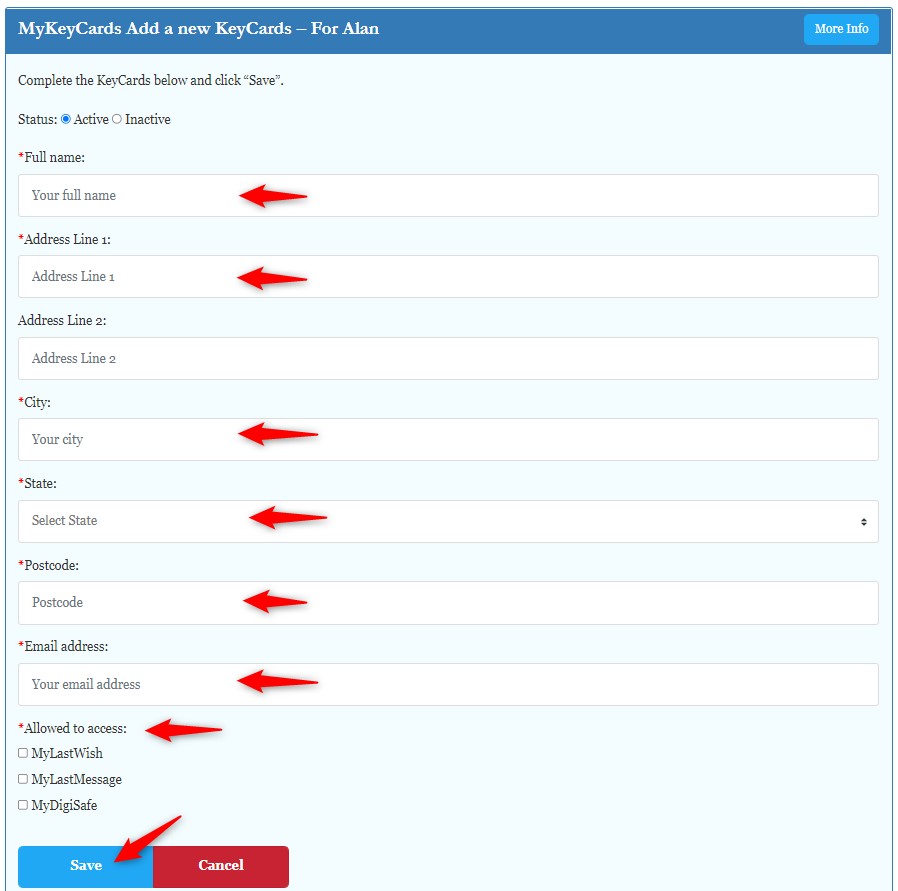

First go to your Dashboard and generate a new identifier, if you have not already done so.

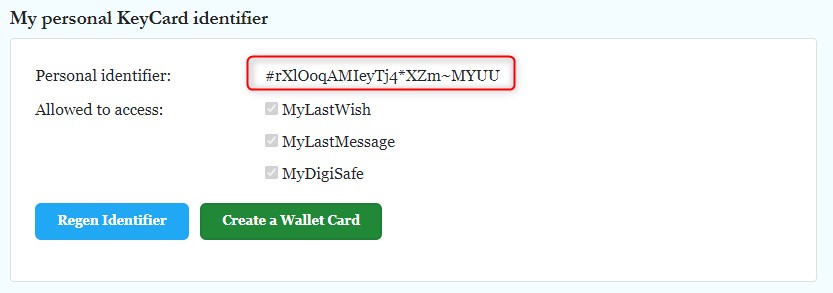

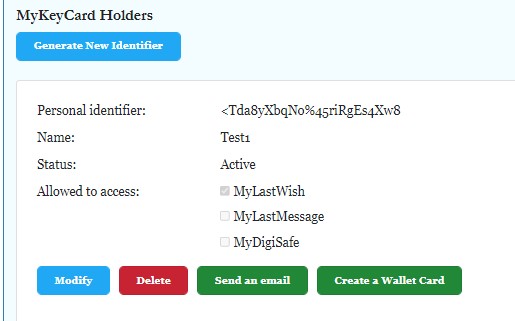

Your personal identified has been created.

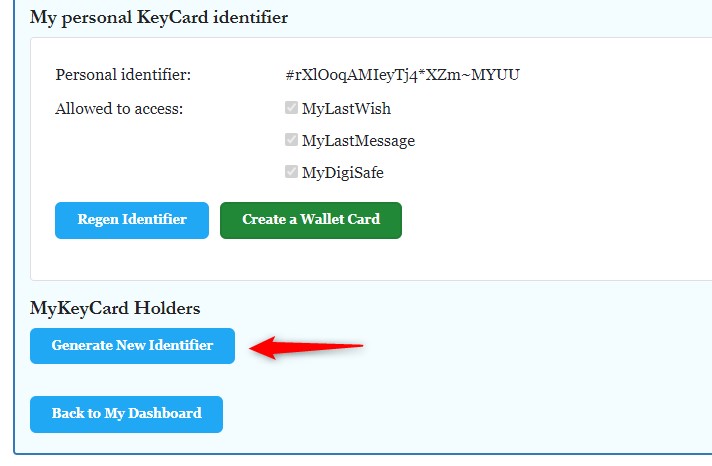

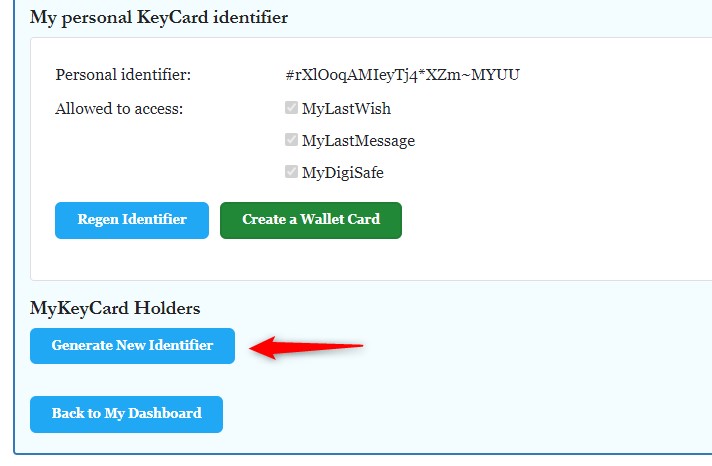

Now let’s create a unique Key identifier for your chosen ones.

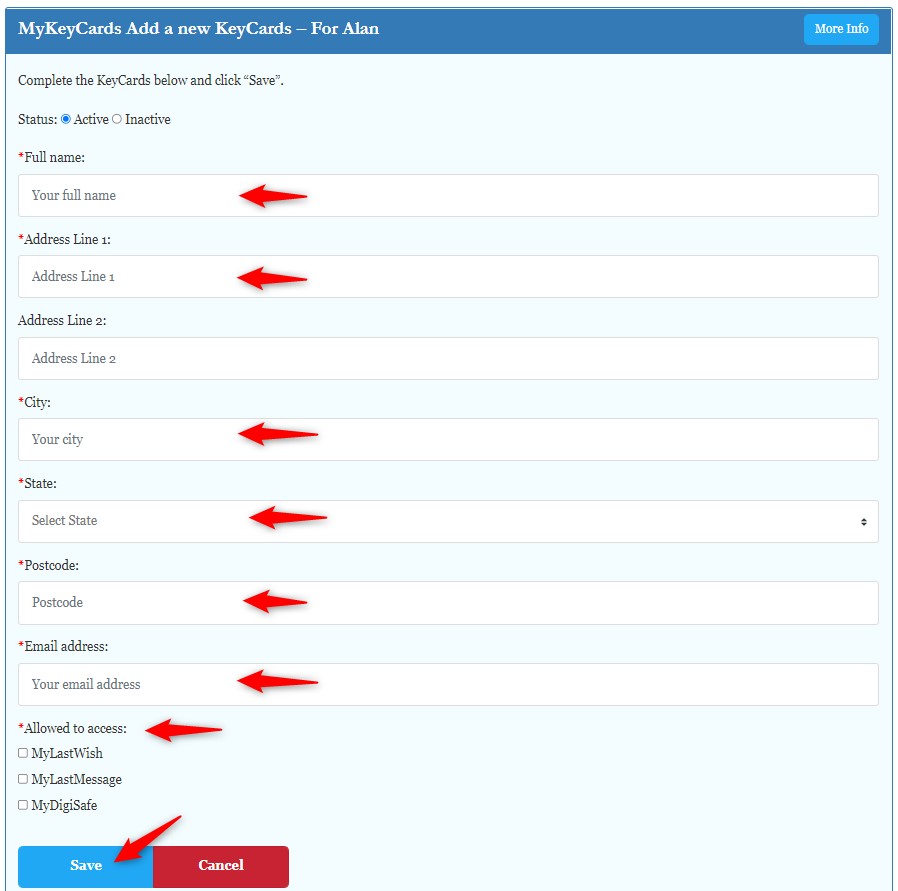

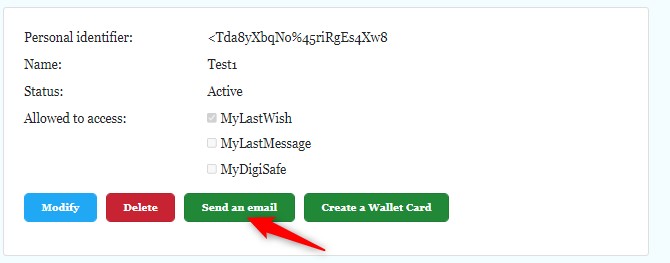

Complete the information for the recipient of the unique identifier. KeyCard holders are people you trust to unlock your wishes when the time is right. You can designate unlimited number of different KeyCard Holders. You may specify what exactly each can unlock. Each KeyCard Holder will be assigned a uniquely system generated alphanumeric identifier. Only using this unique identifier can the KeyCard Holder unlock your wishes.

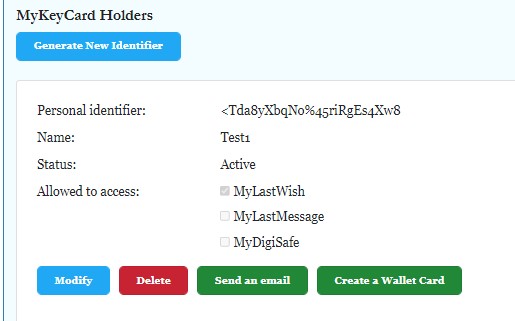

Your KeyCard holder has been added successfully.

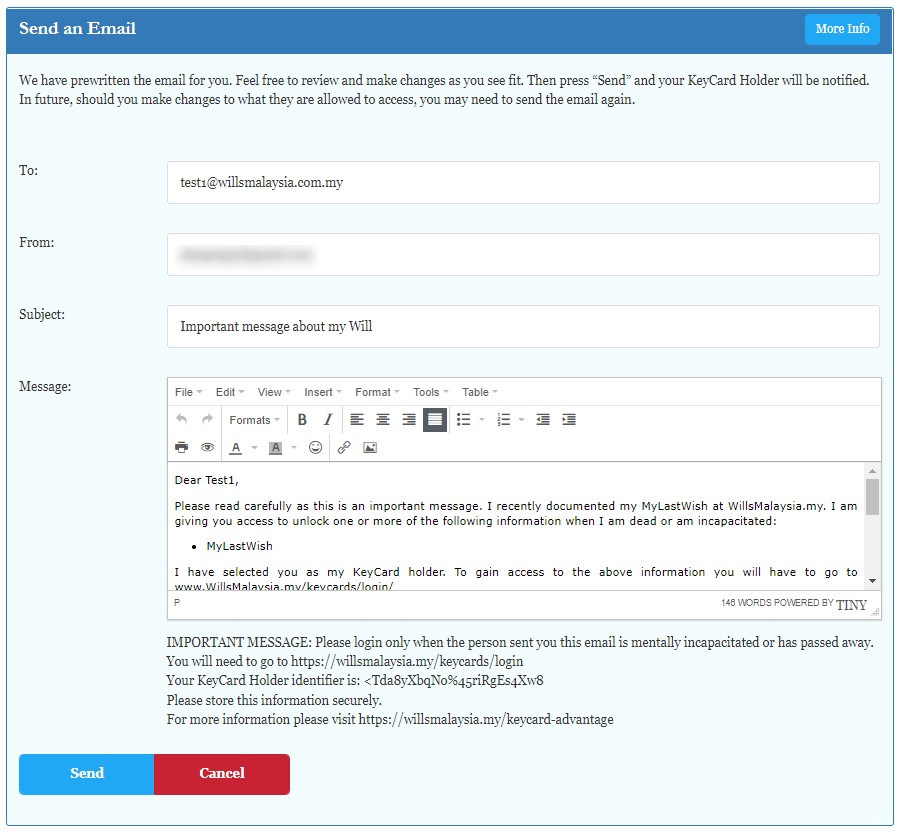

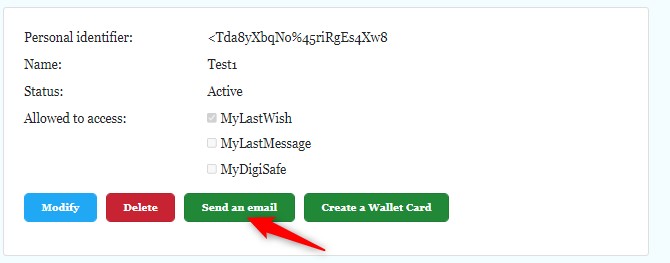

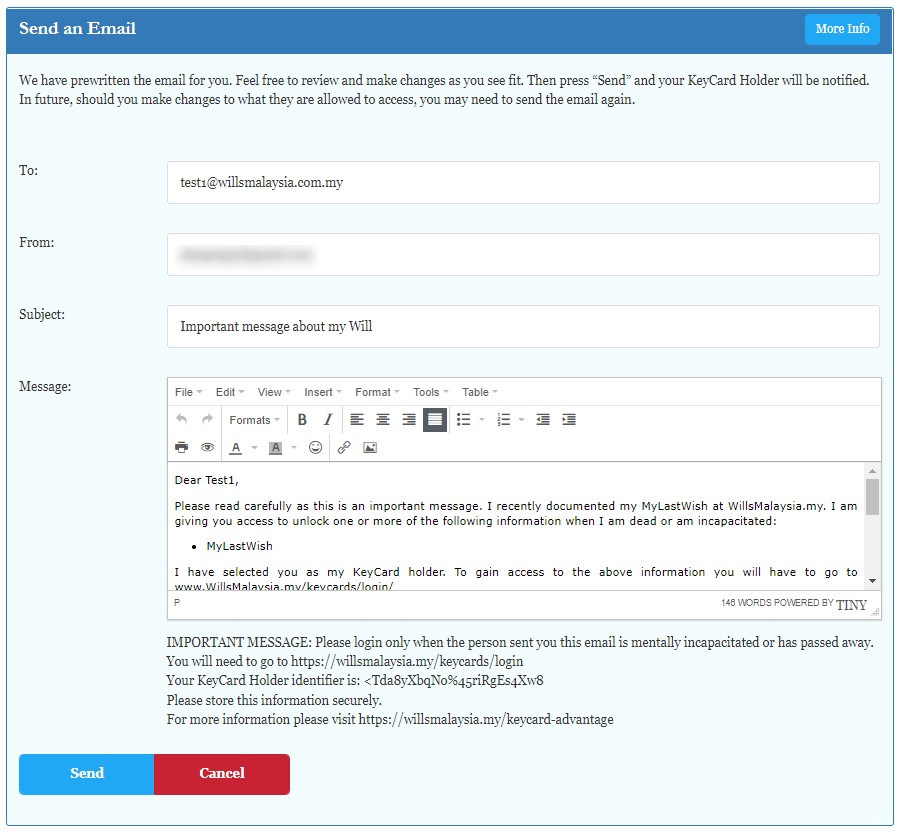

Now the most important part – the email.

Send an email to your KeyCard Holder informing them of your decision in selecting them as your KeyCard Holders. This is an important step in letting them know. You do not want to surprise them. We have pre-written an email for you. Feel free to review and make changes as you see fit. Then press “Send” and your KeyCard Holder will be notified. However in future, should you make changes to what they are allowed to access, you may need to send the email again.

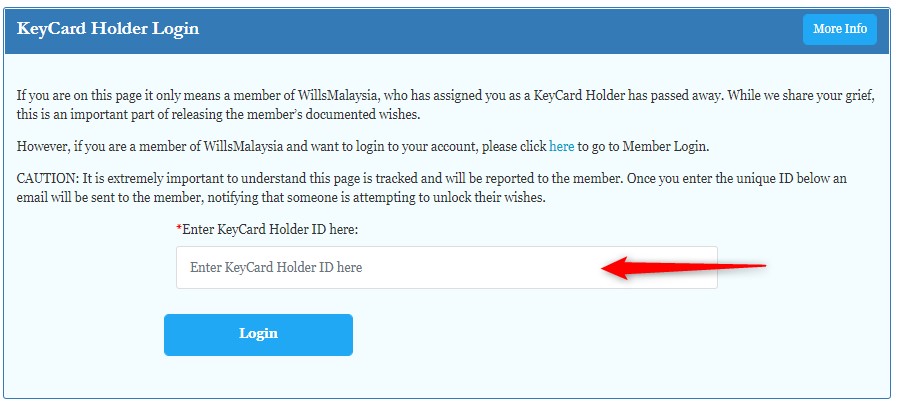

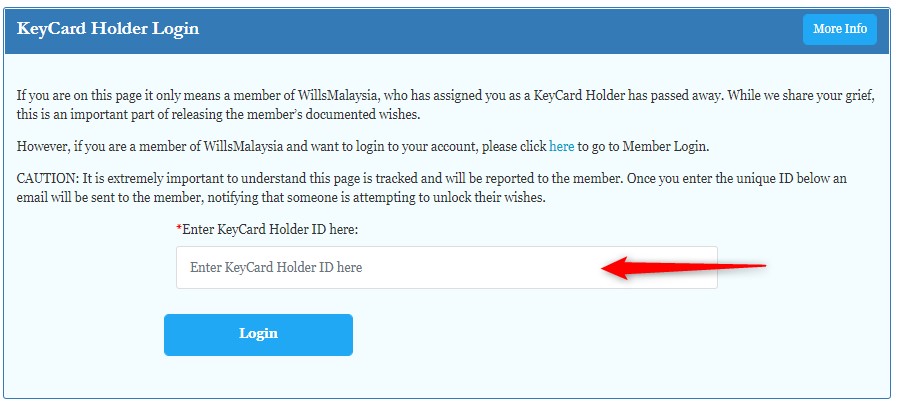

In the unfortunate event your KeyCard Holder has to release your wishes, they have to go to https://willsmalaysia.my/keycards/login

If they were to attempt to view or release your documents while you are still alive, you will be notified of the attempt via email. If you do not respond in the given timeframe, then they can release your documents.

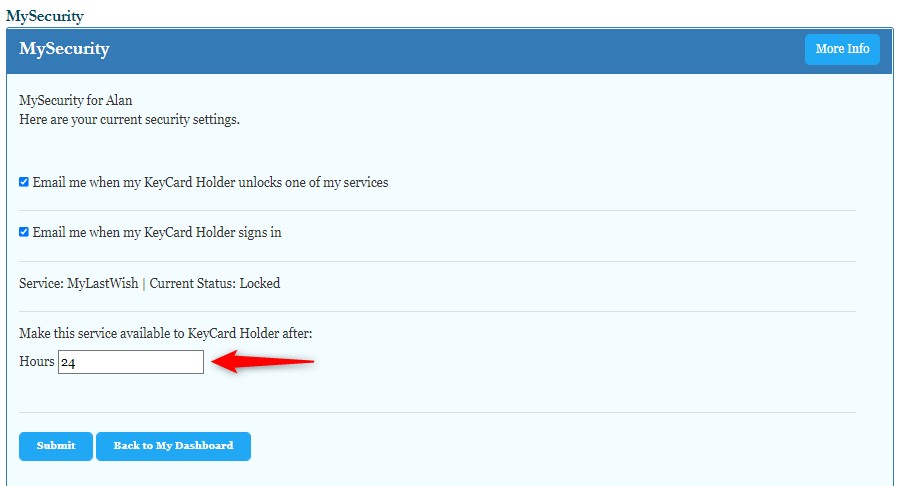

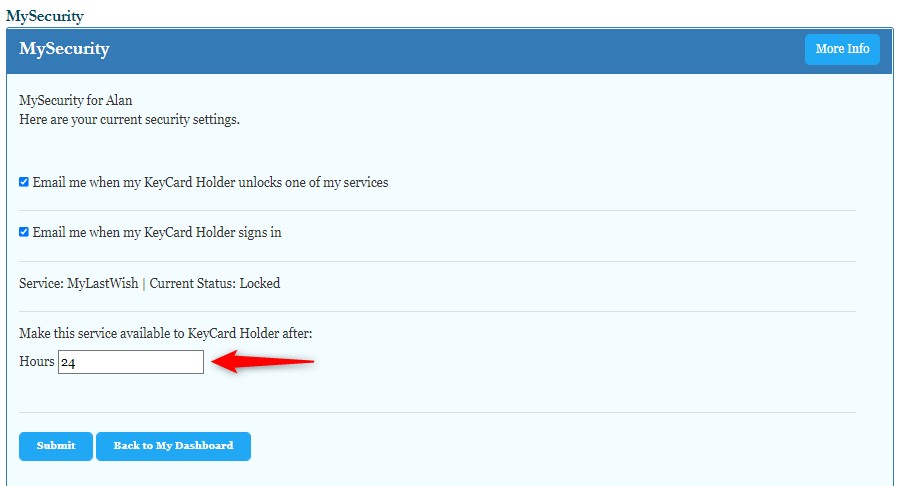

The timeframe to release, with no response from you, can be found in your Dashboard, MySecurity.

This is your security settings for your KeyCard Holder. You will also be able to monitor who logins in. The email notification by default is set to on. The timer is set to 24 hours. You can change it to any number of hours you wish.

WillsMalaysia does not inform or get involved in notifying your beneficiaries or executors. All notifications are done automatically.

For this purpose we highly recommend you use MyLastMessage. This FREE service allows you to create messages to anyone you like as long as you have their email address. These messages will stay active until your designated KeyCard Holder releases them. Your KeyCard Holder will not be able to read or modify any message. They only have the ability to click a button to send all messages. It is important that you have at least one KeyCard Holder assigned to release your messages.

Release of your wishes

In the unfortunate event your KeyCard Holder has to release your wishes, they have to go to https://willsmalaysia.my/keycards/login

a. There should be only one reason why you are here. Please make sure you understand that once you release the wishes and documents, you can't take it back. Our member has placed their trust in you to only release their wishes upon their demise. If you understand this, then please input the unique identifier and proceed.

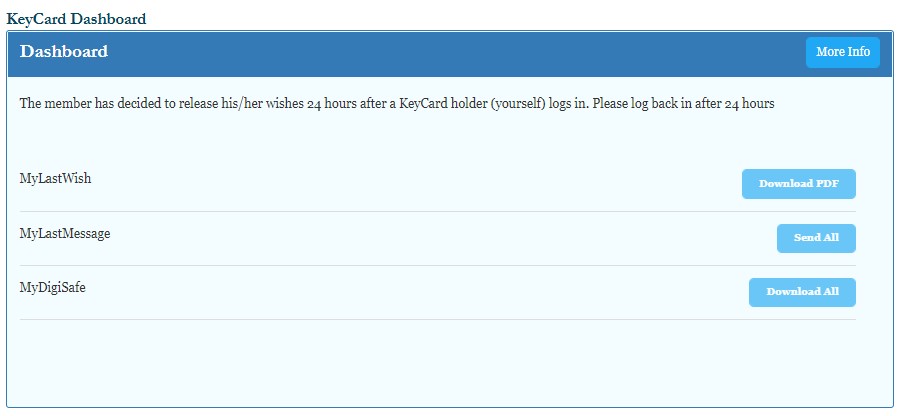

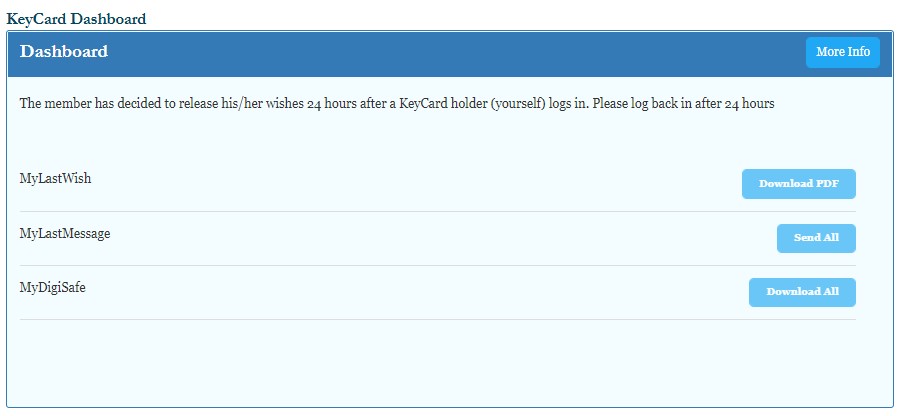

b. Once the identifier has been entered, the KeyCard holder will be brought to this page:

Now that you are here, it means the person who trusted you with their information is ready to release it. However for security reasons they have set a timer for the documents to be released. You may log back in after the timer has expired and release the documents.

D) Security

1 Is my information secure?

Absolutely! Your information stored at WillsMalaysia.my is safe and secure. The information is highly encrypted so that nobody has access to this information, other than yourself and your trusted KeyCard® holder. Even we at WillsMalaysia are not able to access your information due to the highly secured software design and encryption methods used.

All data transfer from your computer to WillsMalaysia.my is authenticated and encrypted using 256-bit "SSL encryption". Secure Socket Layer (SSL) is a protocol developed for transmitting private data over the Internet. SSL is a way to ensure that sensitive data received from users or web site visitors are safe and remains private.

The SSL protocol uses a cryptographic system that uses two keys to encrypt data, a public key known to everyone and a private key known only to the recipient of the message. This ensures that data pass between two entities over the internet shall be encrypted upon transmission. Websites uses the encrypted data channel to obtain confidential user information such as credit card numbers, personal data, business data, emails or login credentials.

Web sites with SSL have the following characteristics:

The URL or web address changes from http:// to https://.

The padlock sign on the browser changes from open to close.

The address bar will turn to green and display the name of website owner when connecting to a website protected by Extended Validation SSL certificate.

Websites that incur payment transaction, online ordering, booking, submission of any user information or have client login area requires a secured connection to ensure customer/user confidence when submitting data to your website. With SSL certificate installed, customers/users feels secure and confident when interacting with you through your website.

The primary goal is to have a secure connection between user and your website to prevent hackers from stealing sensitive data from your web user and your organization.

2 Can my information get destroyed or lost?

Our servers runs on RAID1 data mirror where two hard-disk runs simultaneously. This is to prevent data lost during single hard disk failure. We do perform schedule backups to different servers.

Datacenters

We work closely with out hosting provider to design, build and operate the data centers. Each component is carefully selected, each step to build is thoroughly evaluated -- from our location selection to choice of hardware components, each is vetted to solve the next generation of challenges. We work closely with our technology providers to solve for stability, performance, and efficiency.

Network

We work closely with out hosting provider to use our own dedicated 20Tbps fiber-optic network capacity, 30 data centers, and an additional 34 points of presence, we are well able to handle growing volumes of data. Along with links being at least doubled at every routing point, we build our infrastructure to optimize for stability, redundancy and availability. Real-time status, ping testing, and anti-DDoS—all to ensure you stay online.

Quality & Certifications

The protection of our customer data is vital. We invest in the highest levels of security and adopt industry best practices to meet compliance and certification standards.

Security & Data Protection

Security is our priority. The trust that our customers and partners place in us is paramount. Security is at the core of our focus and attention, at every level of our organization and infrastructure. We live amidst a global threat that is increasingly sophisticated and dangerous. To seize this challenge, we put security at the forefront of our activities in our datacenters.

E) Other Questions

1 Foreigners and Will

Malaysia recognises the validity of international wills that relate to properties and assets owned by the testator in other parts of the world. However, it is highly recommended that a foreigner make a will in Malaysia under the following circumstances:

a) They are living in Malaysia and would be considered a ‘permanent resident’ of Malaysia at the time of their passing. This includes people with work permits and resident pass holders.

b) They own immovable properties in Malaysia (land, buildings, house, apartments etc) or moveable properties in Malaysia (Bank accounts, EPF, Insurance etc)

Failure to make a will in Malaysia may mean that delays could occur in the transfer of their properties and assets in Malaysia to their beneficiaries, wherever they may be. In short, having a will made in their country of origin that covers all assets is still valid, but there may still be delays when it is applied in Malaysia, especially when it involves immovable properties bound by administrative red tape. As such, it would be advisable to make a will in Malaysia addressing Malaysian properties and assets to avoid the risk of delays that may take years to settle.

How to use our system for Foreigners?

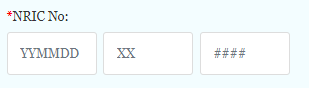

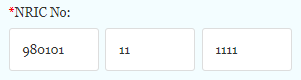

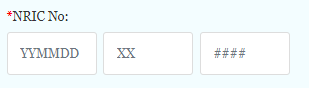

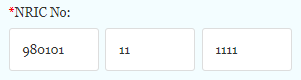

In Section 2.0 Personal Details you will be asked for NRIC.

Here you need to input your date of birth in YYMMDD, XX = 11 and #### = 1111 like shown below.

Then continue using the wizard all the way until the end.

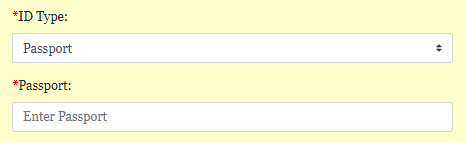

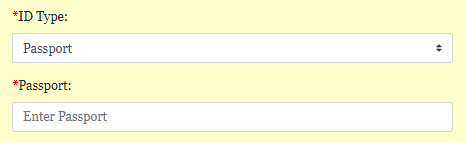

When defining Beneficiaries, select gender and then select Passport if not Malaysian

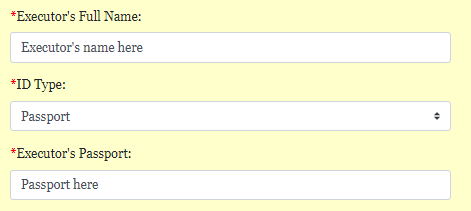

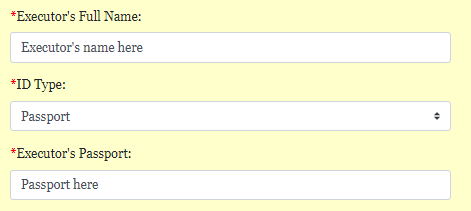

When selecting an Executor who does not have a Malaysian NRIC, you may do as follows.

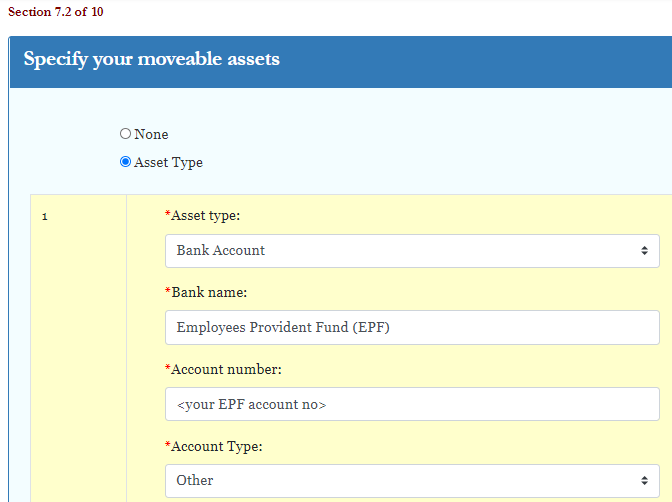

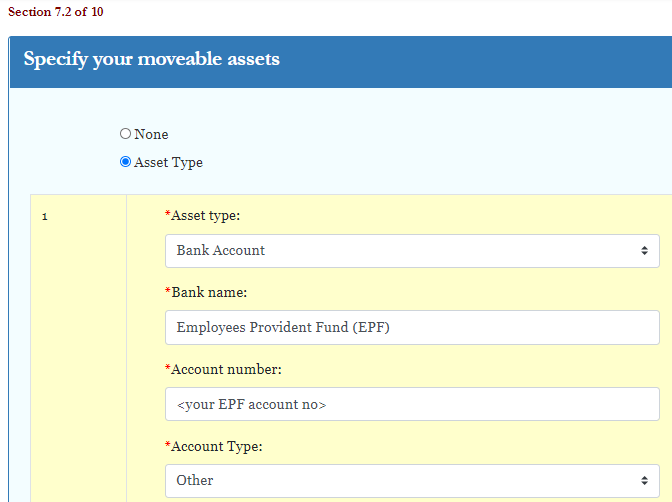

When you reach section 7.2 to declare your moveable assets, your EPF can be updated as follows:

Once you have updated the system with all your information and has seen the preview, you may proceed to make payment. Upon payment you will be able to download your will as Microsoft Word document. Here you will need to update “NRIC: YYMMDD-11-1111” to “Passport: <your passport no>”. There will be three places to replace: Cover page, First page and Last page. Now your Last Will & Testament is good to be executed by you and your witnesses.

You may still use our complimentary services MyDigiSafe, MyLastMessage and MyLastWish no matter where you live.

2 Does it matter where I live?

The short answer is NO. Power of Attorney Act 1949 and Wills Act 1959 covers all States in Malaysia. The age requirement to create these documents is 18 and above in all states except for Sabah where it is 21 years.

Services such as MyLastWish™, MyLegacy™, MyDigiSafe™ and MyLastMessage™ do not create legal documents. We have worked extensively with lawyers in Malaysia to ensure that the legal documents created by the MyLastWill™ and MyPoA™ services are up to date with the laws in Malaysia.

If you have any doubts about the legal standing of your Will or Power of Attorney, feel free to seek any legal counsel of your choice. You can take advantage of our experienced group of lawyers, for a fraction of the cost to review your Will.

3 How can I document my own wishes?

Simply click here, or return to WillsMalaysia at any time to join as a new member or to try out our services. As a new member, you get one-year free membership.

The complete pricing structure is available on our Products & Prices page.

4 Where can I get more information?

If you have additional questions after reading all of the information provided here, feel free to contact us.

We will be most happy to answer your questions.

5 Can I call and talk to someone?

One of the reason why we can offer very competitive pricing is by using technology to the best we can and by removing the need for human intervention. We have an extensive set of FAQs and a library of Informative Videos that can be found here:

https://willsmalaysia.my/faqs

https://willsmalaysia.my/info-videos

You have up to ONE year to try the products for FREE. In addition, being a member of WillsMalaysia, you get exclusive access to unique legal products and membership benefits not offered anywhere else in Malaysia! These membership benefits are specially designed and are included as complementary (FREE) services exclusively for WillsMalaysia members:

MyLastWish - document your funeral wishes and organ donation preference

MyLastMessage - record video messages and create email messages that will be automatically sent upon your demise

MyDigiSafe - store all your digital documents in one place to be retrieved by your loved ones.

If after going through our FAQs and Info Videos you still have questions and would like us to contact you, please provide your phone number and one of our Support staff will contact you.

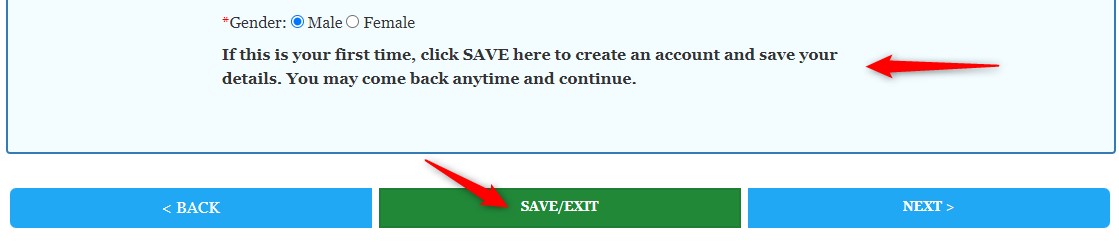

6 How do I register as a member with WillsMalaysia?

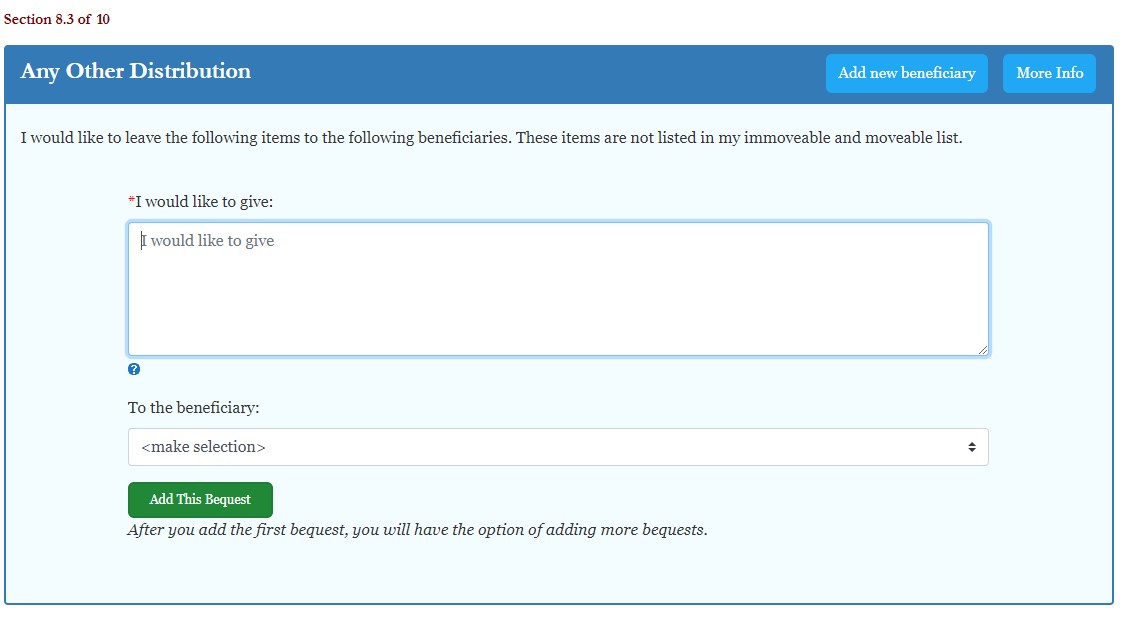

Visitors are encouraged to try out either MyLastWill or MyPoA. As you move along the steps there is a button in the middle for SAVE/EXIT as we understand it may take a while before you complete your will.

When you select SAVE/EXIT system brings you to the registration page with your details pre-populated. System will not lose all data that you have keyed in during the registration process.

For Wills click here: https://willsmalaysia.my/member/mywill-declaration

For PoA click here: https://willsmalaysia.my/mypoa/mypoa-declaration

7 Do you offer any discounts?

We offer a variety of discounts:

Family Discount - Once you join as a member and have made your first purchase, you qualify up to 15% discount offers to be shared with your family and friends.

Military/Police Discount - We value your contribution to our society and country. We offer a 10% discount.

Senior Discount - We recognise our Warga Mas. Your sacrifice and contribution to society will not be forgotten. If you are 65 and older you get an automatically discounted price by 30%.

Spouse Discount - The MySpouseWill service allows members to create a Will for their spouses that mirrors their will, at a 40% discounted price.

*** If you qualify for multiple discounts then the highest discount will be applied. For example if you are 65 years old (30%) and an ex-military (10%) personnel, you qualify for 30% discount.

8 What does first year FREE means?

When you try out any of our service, you automatically get a complimentary membership up to one year. You have up to ONE year to try the products for FREE. In addition, being a member of WillsMalaysia, you get exclusive access to unique legal products and membership benefits not offered anywhere else in Malaysia! These membership benefits are specially designed and are included as complementary (FREE) services exclusively for WillsMalaysia members: MyLastWish - document your funeral wishes and organ donation preference MyLastMessage - record video messages and create email messages that will be automatically sent upon your demise MyDigiSafe - store all your digital documents in one place to be retrieved by your loved ones.

During your FREE trial period, you can only "view" your Will but not able to download it. Once you are happy with the preview, you can pay for it and download your will as a Microsoft Word document. From here onwards, you may check, print and sign together with two witnesses. Your will is then completed.

Every now and then we offer promotions. If you would like to take advantage of the discount then you can purchase using the offered discount code.

1 What are the detail of your partnership with Nirvana Asia?

Details can be found Partnership of Care

2 Where can I see the discount code for Nirvana Asia?

Login to your Dashboard to view your code. The code will be displayed only if you have purchased a product from us. That code will entitle you to a cash gift with Nirvana Asia

3 Can I call Nirvana Asia directly and apply the discount code?

No. The code is only applicable when you contact Nirvana Asia's authorised Agency 1631. Please visit www.centralfuneralcare.com or contact Ellee Wong (Yankee Life Planning Advisory’s Service Director) for more information.